Demystifying the Cost of Education: An In-Depth Guide to EMI Calculators for Students

Related Articles: Demystifying the Cost of Education: An In-Depth Guide to EMI Calculators for Students

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Demystifying the Cost of Education: An In-Depth Guide to EMI Calculators for Students. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Demystifying the Cost of Education: An In-Depth Guide to EMI Calculators for Students

The pursuit of higher education is a significant financial undertaking. For many students, securing a loan is a necessary step to fund their academic journey. Understanding the repayment structure of these loans, particularly through Equated Monthly Installments (EMIs), is crucial for informed financial planning. This article delves into the world of student loan EMI calculators, exploring their functionality, benefits, and how they empower students to make informed financial decisions.

Understanding Student Loan EMI Calculators: A Comprehensive Overview

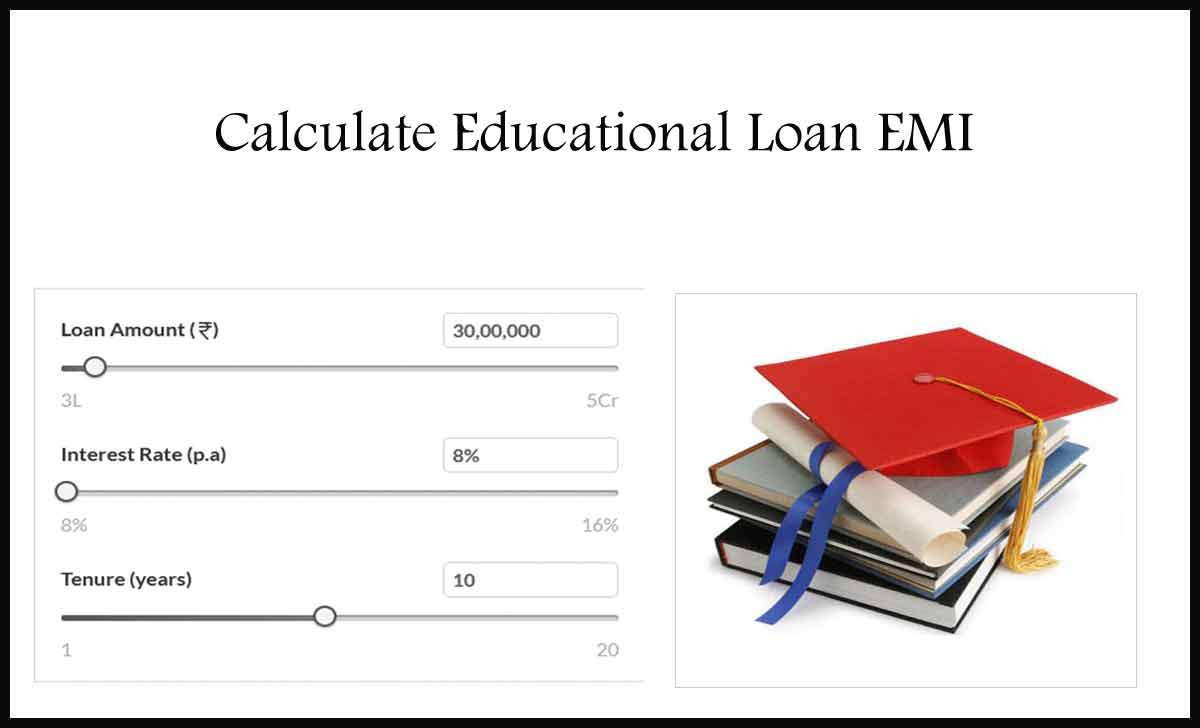

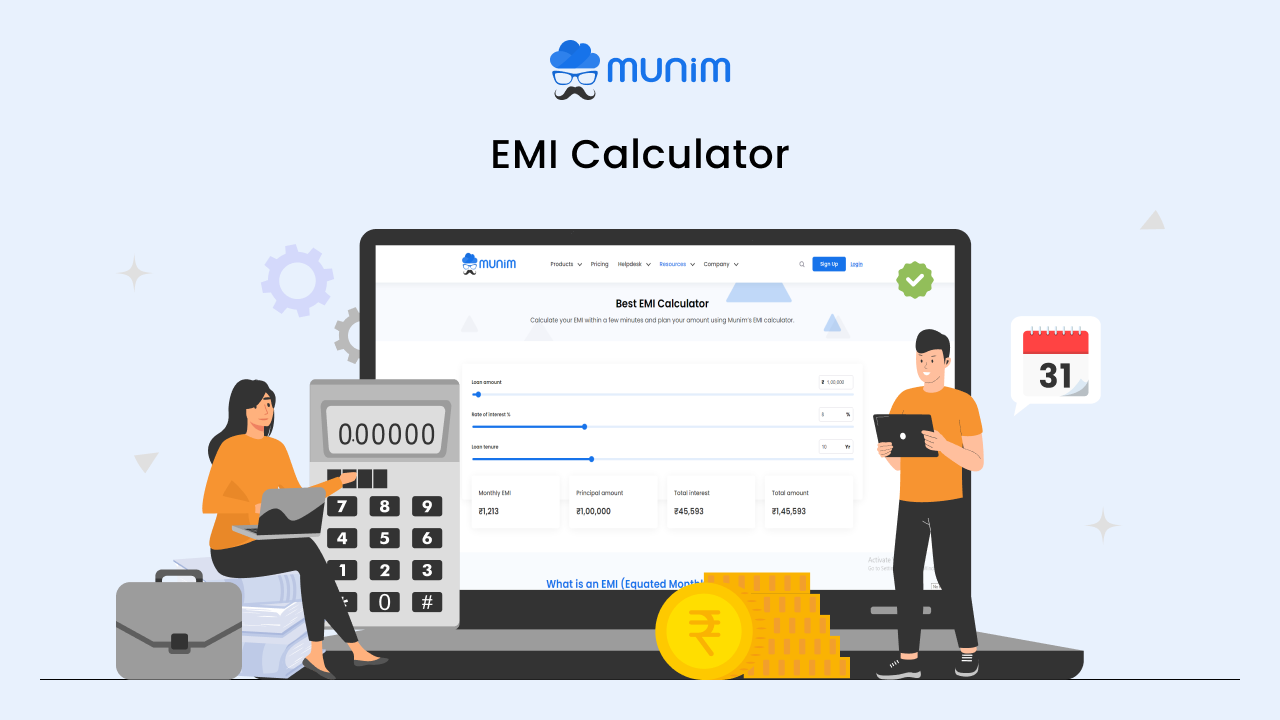

An EMI calculator for student loans is a digital tool that simplifies the complex process of loan repayment by providing a detailed breakdown of the monthly installment amount, total interest payable, and the loan’s overall cost. These calculators typically require the user to input specific loan details, including:

- Loan Amount: The principal amount borrowed.

- Interest Rate: The annual percentage rate (APR) charged on the loan.

- Loan Tenure: The duration of the loan repayment period, usually expressed in months or years.

Based on these inputs, the EMI calculator employs mathematical formulas to calculate the monthly installment amount, taking into account the interest charged over the loan’s lifespan. This comprehensive analysis empowers students to:

- Estimate Repayment Costs: By providing a clear picture of the monthly payments, students can gauge the financial commitment associated with their loan.

- Compare Loan Options: Different lenders may offer varying interest rates and loan terms. An EMI calculator enables students to compare these options and identify the most financially advantageous choice.

- Plan for Repayment: Knowing the monthly installment amount allows students to budget effectively, ensuring they can comfortably manage their repayments while pursuing their studies.

The Importance of Student Loan EMI Calculators: A Beacon of Financial Clarity

Student loan EMI calculators play a vital role in promoting financial literacy and responsible borrowing among students. Their significance can be summarized as follows:

- Transparency and Accountability: By providing a detailed breakdown of repayment costs, EMI calculators foster transparency and accountability in the student loan process. This empowers students to make informed decisions based on a clear understanding of their financial obligations.

- Financial Planning and Budgeting: The ability to estimate monthly payments allows students to incorporate loan repayments into their overall budget, ensuring they can manage their finances effectively throughout their studies.

- Stress Reduction: Knowing the exact repayment amount eliminates uncertainty and potential financial stress, allowing students to focus on their academic pursuits without worrying about unforeseen financial burdens.

- Early Intervention and Financial Wellness: In cases where the estimated monthly payment seems overwhelming, students can proactively explore options like loan consolidation or repayment plans to mitigate financial stress and ensure long-term financial well-being.

Navigating the Labyrinth of Student Loan EMI Calculators: A Guide for Students

The plethora of available EMI calculators can be overwhelming for students. Here’s a breakdown of key factors to consider when choosing a suitable tool:

- Accuracy and Reliability: Opt for calculators from reputable sources like financial institutions, government websites, or established financial technology companies.

- Ease of Use: Choose calculators with user-friendly interfaces, clear instructions, and readily accessible information.

- Features and Functionality: Consider calculators that offer additional features like loan amortization schedules, interest rate comparison tools, and repayment calculators.

- Data Security: Ensure the calculator you use adheres to strict data privacy and security protocols to protect your personal information.

Frequently Asked Questions (FAQs) About Student Loan EMI Calculators

Q1: What is the difference between an EMI calculator and a loan amortization schedule?

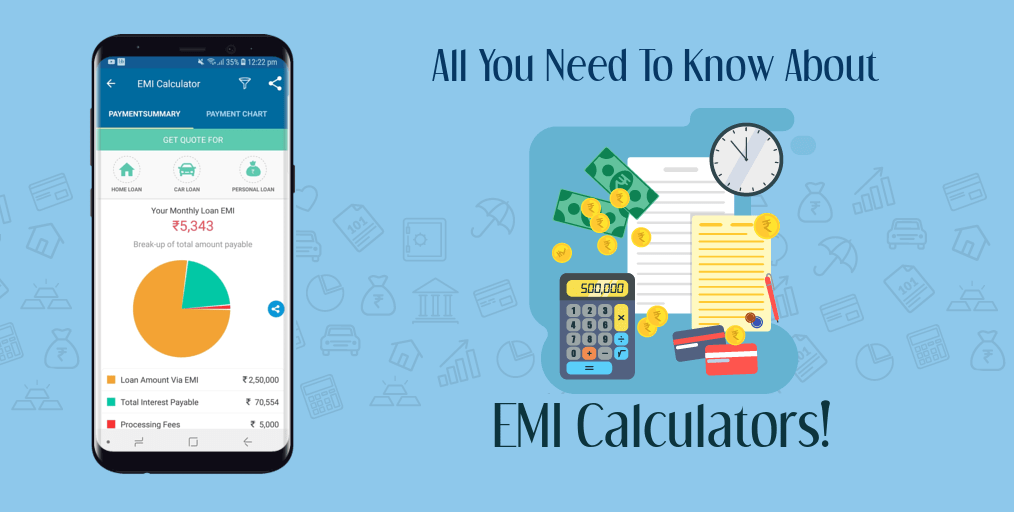

A: An EMI calculator provides a summary of the monthly installment amount, total interest payable, and loan cost. In contrast, a loan amortization schedule provides a detailed breakdown of each payment, including the principal and interest components, over the entire loan tenure.

Q2: Can I use an EMI calculator for different loan types?

A: Most EMI calculators are designed to handle various loan types, including student loans, personal loans, home loans, and car loans. However, it’s essential to verify the calculator’s compatibility with your specific loan type.

Q3: Are there any fees associated with using an EMI calculator?

A: Most online EMI calculators are free to use. However, some platforms may charge a fee for additional features or premium services.

Q4: Can I adjust the loan tenure in an EMI calculator?

A: Yes, most EMI calculators allow you to adjust the loan tenure to explore different repayment options and their impact on the monthly installment amount.

Q5: How often should I use an EMI calculator?

A: It’s recommended to use an EMI calculator at least once before taking out a loan and periodically throughout the loan tenure to track your progress and make informed decisions about your repayment strategy.

Tips for Effective Use of Student Loan EMI Calculators

- Explore Multiple Calculators: Use several EMI calculators from different sources to compare results and ensure accuracy.

- Factor in Interest Rates: Be aware of the interest rates charged on different loan options and their impact on your total repayment cost.

- Consider Loan Tenure: Experiment with different loan tenures to determine the optimal repayment period that aligns with your financial capabilities.

- Include Additional Expenses: Factor in potential loan fees, insurance premiums, or other associated costs into your overall budget.

- Seek Professional Advice: If you have complex financial situations or require personalized guidance, consult a financial advisor for expert advice on managing your student loans.

Conclusion: Empowering Students to Navigate the Financial Landscape

Student loan EMI calculators serve as invaluable tools for students navigating the complex world of higher education financing. By providing a transparent and comprehensive understanding of repayment costs, these calculators empower students to make informed financial decisions, plan effectively, and manage their loan obligations responsibly. As students embark on their academic journeys, embracing the power of EMI calculators can pave the way for a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into Demystifying the Cost of Education: An In-Depth Guide to EMI Calculators for Students. We appreciate your attention to our article. See you in our next article!